Quick Links

PMEGP e-Tracking System Login Form

PMEGP Application Form 2024 | pmegp in hindi pdf |pmegp loan details in hindi pdf|pmegp guidelines in hindi pdf लोन स्कीम || PMEGP Loan Scheme 2024 | pmegp e tracking

The aim of the government is that whoever unemployed youth is can start any business by taking loans and get rid of unemployment because the government believes that if our country remains unemployed, it will not be able to progress. The government believes that there is a lot of talent among the youth of our country. But due to lack of money, they are not able to start any new business of their own, but now it will not happen, they can start their new business by taking loan under PMEGP / pmegp scheme.

Eligibility for PMEGP loan Scheme

- Applicant must be above 18 years of age.

- To take a PMEGP loan, at least one must have passed eighth.

- This loan will also be given to start a new business. This loan is not given to pursue the old business.

- If you have applied for any other government then you will not be given a loan.

Medhavi Chhatra Yojana MP 2024 – Registration, Eligibility, Status & Last Date

PGEMP LOAN के लिए जरूरी कागजात Aadhar Card

- voter card

- Pan Card

- Passport Size Photo

- Bonafide

How much loan will be provided by PMEGP loan?

- Friends, now we will tell you how much loan you will be given to do business, so that you can start a new business.

- The open category person will get 25% grant to start an industry in rural department and 15% grant to start an industry in urban department, in which you have to raise 10% yourself.

- Person of Special Category / OBC Ex-serviceman will get 35% grant for starting an industry in rural department and 25% grant for starting an industry in urban department, in which you will have to raise 5% yourself.

Ksheerasree Portal 2024 Kerala: Login, Farmer Registration @kerala gov in

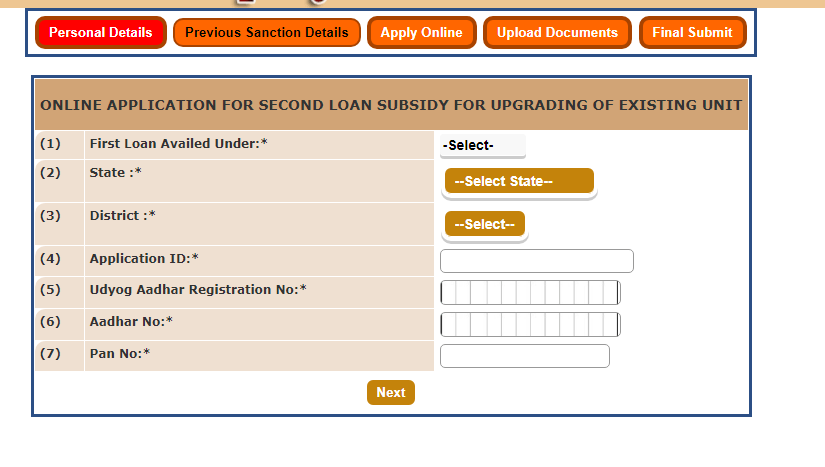

How to Apply

- Friends, if you want to take a loan for business, then you have to click here.

- After clicking on the website, the application form will open in front of you.

- Fill all the information in it carefully.

- The PMEGP LOAN application form is sent to the district office for approval by the KVIC.

- From there you will be sent to your bank / bank for investigation.

- If all your documents are found right in the bank, then you are given a loan so that you can start your new business.

Check More Upcoming Schemes in India

We hope that the information given by us has proved beneficial to you, for more such information, stay connected with us like this and tell us your opinion by commenting, it helps us to bring more better content in future, thanks.